How Growth Can Stall And What To Do Next

A midsize healthcare network had a good problem: Patient demand was rising.

They were opening new locations. Appointment slots were filling faster than expected. Word-of-mouth referrals were climbing.

But instead of celebrating, the CEO was cautious. She wanted to see “how the numbers looked” before committing to more staff, new equipment, or a tech upgrade.

“Let’s wait another quarter before we invest.”

Three months later, the wait times had doubled. The call center was swamped. Patients started leaving for providers who could see them faster.

Revenue flattened, then slid. The leadership team said: “The market’s cooling.” In reality, the market wasn’t cooling; they were.

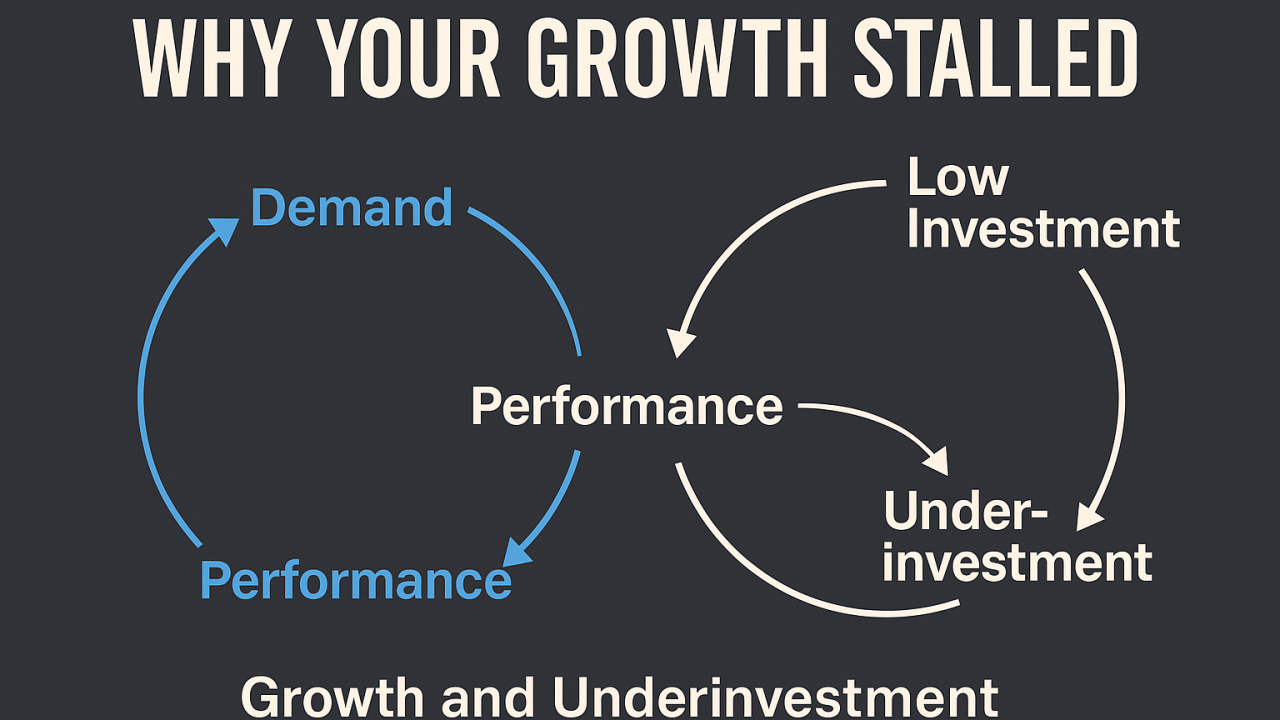

The System: Growth and Underinvestment

Peter Senge’s Growth and Underinvestment model describes it perfectly:

- Demand increases = The system starts to grow.

- Capacity is not increased fast enough = The gap between demand and capacity widens.

- Performance suffers = Customers leave; growth slows.

- Slowing growth becomes the excuse not to invest = Leaders believe the market isn’t there. They don’t recognize that they created the slowdown by starving the system.

How It Looks in Real Life

- Healthcare: Clinics delay adding staff or upgrading EMR systems until “we’re sure the volume will last” . Then they lose patients to faster competitors.

- Law Firms: Partners hesitate to hire associates or automate intake; caseloads back up; clients find other firms.

- Agencies: Campaign demand spikes, but leadership waits to expand the creative team; deadlines slip, clients churn.

The False Comfort of “Waiting”

The logic sounds responsible: “Let’s be sure before we spend.” But in systems, delayed investment is delayed capacity… and delayed capacity is lost opportunity you can’t get back.

By the time performance drops, the damage is already done. Patients or customers have left. Reputation has slipped. And no amount of late investment will catch you back up instantly.

How to Break the Cycle

- Recognize Early Growth Signals. Don’t wait for a perfect forecast. Look for leading indicators: pipeline velocity, referral spikes, backlog length.

- Invest Ahead of the Curve. Build capacity just before you feel the pinch, not after. In fast-moving systems, lag kills.

- Model the Cost of Inaction. Calculate what one month of lost customers is worth… and stack it against the cost of building capacity now.

- Separate Risk from Fear. Risk is measurable; fear is not. Make your call based on the numbers, not comfort.

- Tie Investment to Identity. “We are the kind of organization that scales to meet demand” beats “We’ll see if the demand sticks.”

Back to Our Healthcare Network

Six months after demand began rising, they finally approved the budget. By then, two competitor groups had opened new locations nearby. The practice survived, but the cost was high, avoidable, and they only recovered a small percentage of the backlog of patients.

It wasn’t the market that slowed them down; it was their hesitation.

In business, underinvestment feels safe in the short term. In systems, it’s the fastest way to stall your own growth… and hand momentum to someone else.

So… where are you waiting right now? And what would happen if you invested before the pinch hit?

Leave a Reply